Say… I’m a top-dog banker. Better yet, I’m the one running the printers. Well one day, some no good two-timing punk-ass kid called Bitcoin appeared out of nowhere, gunning for my lunch.

What is this nonsense?

Another fly to swat.

A really annoying fly.

After a few failed attempts to sabotage the project, I’ve decided that if I can’t beat them, I might as well join them… and in the process, own them.

(Like everything else.) 🙂

Ever seen one of those days when coinmarketcap.com showed all green, or all red?

Yep, that was me.

I don’t care what cryptocurrency I’m buying. Proof-Of-Work? Proof-Of-Stake? Who gives a sh*t?! Try this one on for size: Proof-Of-I-Piss-More-Money-For-Breakfast-Than-All-Of-Your-Net-Worths-Combined, fool!

This is how it works:

How Institutional Buyers Quietly Take Your Crypto Away

You have bills to pay. Bills you pay in dollars. I don’t. When you pay, I’m the one you’re paying.

Whatever “gains” you have, you’re going to hand over to me. They will become my gains.

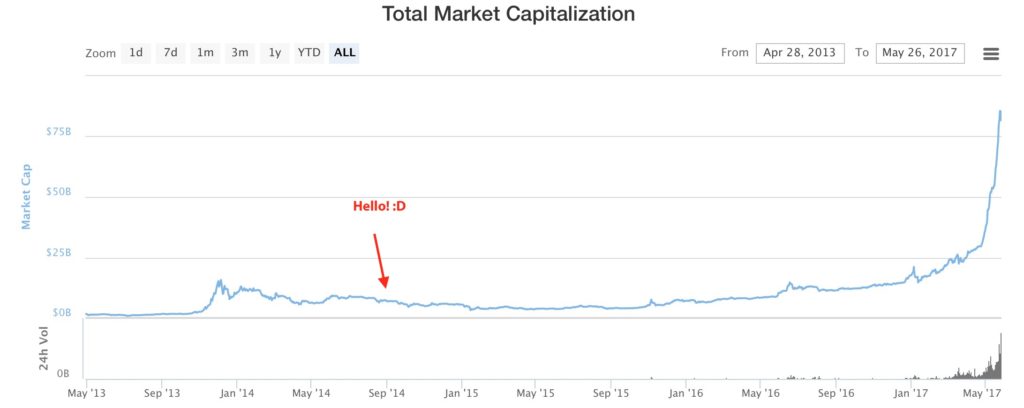

See, right around here, I started buying:

Every time you sell, I get your lunch money. Whether it be from the taxes exchanges pay, the taxes you pay, or because I happened to be on the other side of that trade, I get your Bitcoin, and you get my dollars.

Dollars I’m more than happy to give. (There’s plenty more where those came from! 🤗)

I could buy the entire market in one day if I wanted to—with pocket change—but lack of liquidity in the market doesn’t allow me to. So I’ll do it a day at a time.

Sure, because I can’t create Bitcoin, I’m forced to go through this rigmarole, but it’s OK, I’ve done it countless times before. I have my hands in every pocket.

Publicly, I’ll poo-poo Bitcoin. Privately, I’ll own it. Hell, I might even grow to like it! 😜

Is It A “Bubble”? Or Just Value Realization

You’re all my slaves. I don’t care how much money you think you have — I control dollars, and therefore, I control you.

Sure, we all know Bitcoin (and certainly the entire cryptocurrency market), is worth more than Facebook, but how long can you hang on before we get there?

Share this with anyone who dares say the word "bubble". pic.twitter.com/UnPA3Rll78

— Greg Slepak (@taoeffect) May 23, 2017

I’m the one creating these waves. I buy a lot, wait for the happy faces (“all green!”), then I sell. When I sell, it doesn’t take long to show all red. People panic. “Bubble!”. It is and it isn’t a bubble. Schrodinger’s bubble. I make them. Push. Pull. Splash. Wait. Push. Pull. Splash. Wait. In, out. In, out. It’s like sex, except sex that ends with me owning your bitcoins, and you again my slave.

What Can You Do?

Let’s say you notice that some cryptocurrency is consistently undervalued, so you buy it. That might give you a smoother ride, but remember, I buy them all! Even the sh*t coins. I don’t have time or the interest to sort out which ones are which. Top 100? Mine. Just in case.

No one can stop me. True, those who are able to hold on and ride out these waves could become a problem later on… but that’s not going to happen.

Admit it. You still need those dollars.

You still pay your rent in dollars.

You still buy your food in dollars.

You still measure your cryptocurrency in dollars.

Like a junky, you’ll keep coming back.

And soon, you will be mine.

😘

xoxo

— Your friendly neighborhood Cthulhu

Addendum

From twitter:

@taoeffect I measure my crypto value in BTC 🙂 pic.twitter.com/bF4cYPDZqM

— Aran Dunkley (@AranDunkley) May 26, 2017

Same here. I'd rather be poor than finance the United States war machine. ? $USD.https://t.co/5UqQAlNXwe

— Greg Slepak (@taoeffect) May 26, 2017

OH: "I haven't yet regretted buying bitcoin but I've always regretted selling it." #HODL

— John Light (@lightcoin) May 10, 2017

Good news (not mentioned in this post) is that other mega-mega rich people exist. Expect a "battle of the titans".https://t.co/sxGVcV10Ld

— Greg Slepak (@taoeffect) May 27, 2017

HODL. ✊

You should be beaten with a tire iron for your writing style.

Interesting point, but seriously, tire iron. You deserve it.

I think this is the most obnoxiously written piece I’ve read on the web this year.

Hi Samuel, thanks for sharing your perspective on the physical abuse you believe I deserve for this post!

Regarding the “obnoxious” tone: consider whether that might have been an intentional rhetorical device? 😉

Agree that hedge funds are probably involved to a degree, but your scenario is only possible as long as noobs are in the market. Once all the noobs have been bought out, the market will go back to being semi-pro and pro day traders. These guys generally don’t cash out to fiat, they move from BTC to alts and back, so one or the other will always be a good buy.